W

hen the last government development contract was completed in late 1955, the company's officers gave a sigh of relief. Never again would they get themselves involved with keeping voluminous cost data and playing host to a parade of inspectors and auditors. From then on their business would be strictly commercial, and they would produce standard equipment at fixed prices. Buyers would not be allowed into the plant to inspect equipment before shipment. Nor would they be allowed into the plant to inspect quality control procedures. Nor would the company give out cost information.

Mrs. Hastings put the new policies in writing, drawing up a series of four hand-out sheets outlining these policies along with the company's warranties and other general information.

One afternoon, when the forms were almost complete, she was going over some of the wording with Ray Doyle.

The new policy in action:

Ray Doyle receives a typical "request for quotation."

He discovers it calls for cost breakdowns, source inspections, and all the usual ASPR's and boilerplate.

He processes it in strict accordance with company policy.

|

"They look good to me," Doyle said. "But each one needs a number or a code to identify it."

"What do you suggest?" she asked.

"As far as I'm concerned," Doyle replied, "they are Go To Hell Forms One, Two, Three, and Four."

"We can't very well write that on them."

"No, but we could put GTH 1, 2, 3, and 4."

"And what if somebody asks what GTH stands for?"

"Well, we'll tell them it stands for General Terms of Hastings!"

And so they did.

Enforcing the new policies required constant attention to the terms and conditions listed on a prospective buyer's purchase order. Time and time again, especially from the federal government or one of its subcontractors, orders and contracts came in with clauses calling for cost information or in-plant inspections. Time and time again, Charles Hastings, or Arthur Samet, or Ray Doyle, told the person involved that Hastings-Raydist could not accept such a clause.

"But you have to accept that clause," the person would say.

"Oh?" was the reply. "Bear in mind that I don't have to accept your order."

Usually, the company got the order—on its own terms.

W

hile in Nevada for the 1955 nuclear bomb tests, Arthur Samet had talked to some of the officials about their plans for the future. They told him that for the 1956 tests in the Pacific they wanted to have a number of planes in the air at the time of the blast, each simulating having delivered the bomb. Each of these "weapons-effects" planes would be heavily instrumented to record the effects on the aircraft of being in the vicinity of the bomb as it went off. For this study, they needed to position about half a dozen aircraft going predetermined speeds at various distances and altitudes from ground zero. This would require a system that could not only track aircraft, but could guide them in real time. Was Raydist capable of doing this?

Samet said yes.

In preparation for the 1956 tests, the Air Force set up a practice range in Florida. A route between Grand Bahama Island and Cocoa Beach, Florida, simulated the route between Eniwetok Atoll, where the planes would take off, and Bikini Atoll, where the bomb would go off. Since both courses ran over salt water in tropical conditions and were approximately the same length, the ability of a system to perform well on the Florida course was considered a good test of its ability to perform in the Pacific.

But Raydist was only one of many systems vying for this contract.

One of the biggest problems for all the systems was "skywave," high angle radiation reflections of radio signals off various layers of the lower stratosphere. Signals would go up there, be reflected back, and raise havoc with the equipment. The effects of skywave are worst at sun-up and sun-down. Since the tests in the Pacific would be made in pre-dawn darkness, the ability of a system to resist interference by skywave would be a major determinant of whether or not it could perform the job.

Floyd Gibbs remembers the tests:

The final choice for who would get the contract was made the week before Christmas, 1955. The Raydist crew had spent the last six months there, tailoring our system to deliver peak performance under the test conditions. Among other improvements, we had developed a new damping system to reduce the effects of skywave, and we thought we'd do well in the tests.

There were at least a dozen other electronic concerns there trying to get the contract, and some of them were very technically capable and large organizations.

Each system was tested separately, and competitors were allowed to observe each other's tests if they wished. On the day of our test one of our competitors was invited to watch. His system had been tested the day before, and had been knocked out of the running by skywave.

One of the Raydist engineers there was Howard Moody, and he decided to play a joke on that guy. The night before our test, Howard went up to the shop on the Navy base there and had a couple of his sailor buddies weld him a six-inch cube out of quarter-inch steel plates. A piece of welding wire was attached to the top of it to look like an antenna. They painted the box black, and painted S.W.E. on the side of it in big red letters.

The Southampton plant gets a fresh look—a new logo and brick facade. (1956)

|

The next morning, we set up our equipment for the test. As the Air Force people and our competitor watch, Howard makes a great production of putting the box in just the right spot. He puts it in one location, checks his instruments, then moves it to a slightly different location. After going through this routine a few times, he proclaims that the Raydist system is ready now, and that the pilot can take off. Everyone's attention is riveted on this mysterious black box.

Our tests go well, perfectly—a storybook mission.

After it's over, our competitor asks Howard, What's the box? Howard pretends not to hear, and goes on about his business. The man gets more and more curious, and finally says, "What the hell is an S.W.E.?" Without raising his head, Howard deadpans, "A Skywave Eliminator."

Then Howard and I go into the next room. We hear our competitor back in the test room say to the Air Force officer there, "I wonder if these guys will mind if I inspect this S.W.E."

Of course the officer hasn't the faintest idea what it is. "I wouldn't think so," he replies. "Go right ahead."

So our competitor picks it up and looks it over. Eventually he shakes his head and puts it down.

I suppose even now he wonders what the secret of that little black box is.

Meanwhile, we had won the contract.

T

he major reason Raydist Navigation Corporation had been set up was to separate Raydist leasing work from the government research and development contracts of HICO. Now that HICO no longer handled such work, the justification for maintaining separate companies faded.

The cyclical nature of Raydist leasing business could be handled better in a larger organization than the small RNC. RNC had won the contract for the 1956 bomb tests in the Pacific, but the contract was so large it would take the resources of both companies to handle it. Merging the two companies back together made sense.

The consolidation was completed in April 1956, creating Hastings-Raydist, Inc. Shares of HRI were exchanged for shares of the predecessor companies at the rate of one HRI share for each share of HICO stock and nine new shares for each share of RNC common stock. The ratio of the book values per share of the two companies was closer to 7:1, but a 9:1 ratio for the stocks was considered fair since RNC had been making higher earnings per dollar of book value. The RNC preferred stock was converted to interest-bearing notes to be paid off in 1957.

The officers of Hastings-Raydist were the same as those of HICO, with one exception. Al Budde had left the company when it stopped taking government research and development contracts, and Arthur Samet replaced him as treasurer. In addition to the company officers, the board of directors had three new faces—Franklin Blechman, a local attorney who had advised the company for many years; Herbert Marache, president of a Wall Street investment firm; and P.V.H. Weems, an internationally known authority on navigation.

T

he contract for the 1956 nuclear bomb tests in the Marshall Islands was the largest contract the company had ever had—almost $750,000—and required twenty Raydist men in the Pacific for six months.

Truck-trailers load Raydist equipment for the trip to the Pacific Proving Grounds. The equipment will be used to position and track planes during the 1956 nuclear bomb tests.

|

Above: Raydist antennas on an island in the Pacific receive signals from pursuit ships and bombers.

Above right: Tracking and positioning systems were installed aboard an aircraft carrier. When the installation was complete, the Raydist team had cluttered the flight deck with antennas and equipment vans.

Right: An Air Force lieutenant works in a Raydist bunker on the island of Bikini.

|

|

During the tests, Raydist equipment compared the actual track of each aircraft with its pre-determined, desired flight path. Deviations were converted into heading and speed corrections that automatically operated cockpit instrument panel indicators in the aircraft. This procedure assured the arrival of the aircraft at the desired position, speed, and altitude as the weapon was detonated.

After the tests, Arthur Samet went to see the contracting officer about using Raydist for the 1957 tests to be run in Nevada.

"We won't be needing your gear next year," the officer told him.

"Why not?" Samet asked.

"We had expected Raydist to give us a 40% data return on the job you just did. Instead you gave us 80%. We got such good data from you last time that we don't need any more."

"You're telling me that we did such an excellent job that we don't get any more work?"

"I'm afraid so."

S

eismograph Service Corporation appealed the Federal District Court's decision. It argued that the trial judge was wrong to dismiss SSC's claim on the basis of the equitable doctrine of unclean hands, wrong to rule that the information disclosed by Hastings to Phillips Petroleum and Seismograph was confidential, and wrong to declare the Hawkins patent invalid. Further, it claimed that Hastings had intentionally suppressed important information at the trial, and therefore that the District Court's judgment should be vacated on the grounds of fraud upon the court.

As long as Seismograph was appealing, Hastings decided to cross-appeal. He asked that SSC be required to pay court costs and attorneys' fees for both the trial in the District Court and the appeal, that SCC pay him damages, and that the court permanently enjoin Seismograph from further suits against him.

On October 17, 1958, the U.S. Court of Appeals rendered its decision on the Seismograph case (263 F. 2d 5). The court said:

Seismograph in its brief urges that the opinion of the district court "will shock the senses of propriety and justice of anyone having knowledge of the facts involved. From only a cursory reading of the opinion, it will be obvious that the decision was influenced by deep prejudices against this Appellant and its individual representatives and assumes the existence of improper motives and intentions that are not supported by the evidence. At no point in this opinion does there appear an impartial recitation of the evidence upon which the Court bases its conclusions. Significant and decisive evidence is completely ignored, some of which is so conclusive of certain issues that its omission is not explainable."

… A careful study of the record in connection with the briefs and oral argument has convinced us that these intemperate charges against the district judge are wholly unfounded and improper.

… Appellant further says that the evidence, both verbal and documentary, also shows the trial judge to be clearly erroneous in his decision. While much of the documentary evidence relied upon by appellant is comprised of ex parte memoranda and notes, and while the language of the trial court is severe to the point of blistering the appellant's conduct we find that the trial court's findings of fact are not clearly erroneous … but are supported by substantial evidence and that there is no evidence of prejudice and bias (preconceived or otherwise) on the part of the trial judge.

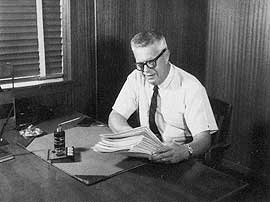

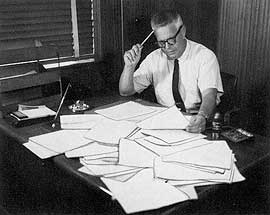

Charles Hastings surveys the mounds of documents generated by the litigation with Seismograph Service Corporation.

Carrying out the decision of the court, Seismograph mails Hastings a certified check for $80,000. At last the patent suit comes to an end.

|

The decision then went into an account of the events of 1947. This account, more thorough than the one the District Court had given in its decision, was detailed even to the point of quoting conversations and correspondence which had occurred between SSC officials as they plotted their strategy against Hastings.

The decision continued:

In conclusion, it is evident that throughout their relationship Seismograph was playing a "cat and mouse" game with Hastings. Since Dr. Hawkins described his conduct as "clean, hard, play" and declared he and his company would repeat their performance, if given an opportunity, saying he spoke for his company in so declaring, we can only conclude that he, as an officer of Seismograph, has erroneous concepts of fair play in business morals and ethics. Beyond a reasonable doubt (which is a much higher standard than our review of facts found by trial judges), the evidence here shows that Seismograph led Hastings through a tortuous path laden with deception, knavery, and misrepresentation. Not once throughout their entire relationship did Seismograph "play it straight" with Hastings.

The court then turned down Seismograph's appeals and turned to those of Hastings.

First it affirmed the trial court's refusal to award damages. Then it considered the request for a permanent injunction against suits by SCC, noting the statement by Hastings' counsel: "While any suit brought against Hastings in the United States on any of these U.S. patents owned by Seismograph would be dismissed for unclean hands, the defendant Hastings can ill afford to bear the expense of any further litigation." Instead of granting the injunction the court decided instead that if Seismograph brought another case against Hastings, the present case could be reopened to allow an injunction against it.

Finally it considered the issue of court costs and attorney fees:

It seems to us that the present litigation is so vexatious and unjustified as to constitute an "exceptional case" within the meaning of 35 U.S.C.A. §285, if that section is ever to be accorded a field of operation, and that the District Court clearly erred and was too charitable to Seismograph in not so holding. We hold, therefore, that court costs and reasonable attorney fees for the appellee should be awarded for both this appeal and for the trial in the District Court, the fees to be awarded by the District Court.

Again Charles Hastings was elated. This decision, awarding him court costs and attorneys' fees, was even better than the last!

T

he decisions in his fights over government disallowances went in his favor too. In the disputes with the Air Force, he won both cases. In the dispute about $45,000, the Army offered to pay him $40,000 one hour before the case was to be heard before the Armed Services Board of Contract Appeals, and he accepted their offer.

Disputes with the Navy over a total of $115,000 did not end until 1960. The Navy eventually sustained $40,000 of disallowances, slightly more than it would have received if it had followed an agreement that it made with him in 1953 and later rejected. On the other hand, he collected back approximately $10,000 of costs he found billable and had not previously asked for.

N

ear the close of 1958, Hastings was approached by a representative from the Small Business Administration, who urged him to get his company involved in government research and development work, and offered to assist him in obtaining these contracts. Hastings told the man that his company had worked on such contracts in the past, that the results had been disastrous, and that he would never become involved with such a contract again. And he described some of the experiences he had had.

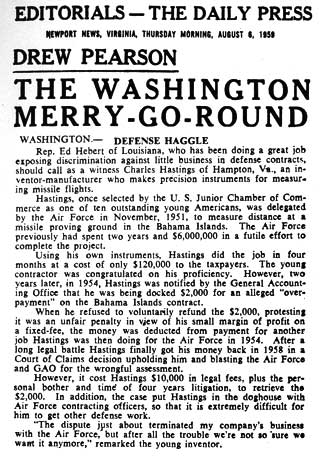

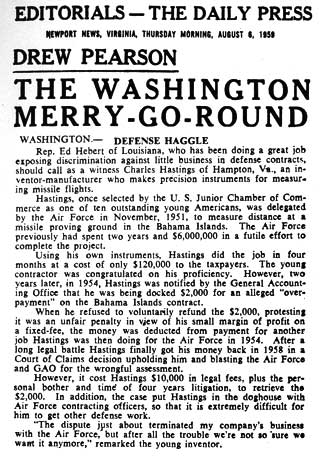

Charles Hastings' testimony about his difficulties with government contracts makes a good story for Drew Pearson's syndicated newspaper column, and for an AP story.

|

The man was shocked, and reported this conversation to his superiors. As a result, Hastings was invited to present his experiences, views, and conclusions to a Senate committee investigating the problems that small businesses have in dealing with the government.

He appeared before the committee on March 20, 1959. He detailed the unfair treatment he had received from the GAO, ending with:

The General Accounting Office has often been referred to as the watchdog of the public purse. I well recognize, gentlemen, the advantages of such a watchdog. However, when the watchdog turns and bites not only the robber, but the butcher, the milkman, the iceman, the neighbor, and even the child, it can truly be said that the watchdog is doing a disservice. In such cases, the dog is usually destroyed and the owner required to pay the price for the dog's action. Too vicious a watchdog is frequently more costly than the possible robber.

He described the cumbersome administration required by cost-plus-fixed-fee contracts, illustrating with the before-and-after figures of his own experience.

To illustrate the great need for a large administration and security force required by these cost-type contracts, let me state that we are at the present time doing approximately the same dollar value of business that we were doing at the height of our cost-type research and development business.

At that time we had almost 200 employees; today we have approximately 60. At that time we had 15 full-time guards; today we have none. At that time we had an accounting department of 10 people, in addition to 4 employees in the expediting and purchasing department; today we have only 3 in the accounting department, and 1 buyer.

And he concluded:

In addition to the difficulties above stated, it is my firm conviction that the entire Government program of cost-plus-fixed-fee contracting is wasteful to the Government and undesirable to small business. Under the various cost-type contracts, our firm must have received a total of approximately $4 million. Never were we able to give a customer so little for his money. The constant harassment resulted in diversion of our most qualified and experienced people, precluded the best and proper performance, and prohibited in most cases the accomplishment of the end results intended by the contract.

At the end of his testimony, he made a list of suggestions for simplifying dealings between the government and small businesses, and the final report of this Senate committee recommended most of the changes Hastings suggested.

T

he instruments side of the business came into its own in the late 1950's. In 1955, when Charles Hastings had been so happy to see instrument sales top the $100,000 mark, they were still less than 15 per cent of HICO sales, and less than 10 per cent of the combined 1955 sales of HICO and RNC.

But from then on the change was dramatic. Instrument sales were up over 50 per cent in 1956, bringing their contribution to 14 per cent of sales. The following year their sales more than doubled, while Raydist had an off year, and suddenly instrument sales accounted for 40 per cent of the company's 1957 revenues. By 1959 they had more than doubled again, allowing instruments to edge out Raydist as a generator of revenue. Never again would instruments be the poor sister to Raydist.

The largest contributor to this surge in instrument business was the growing success of Hastings vacuum gauges. In addition to the contributions made by more and better models of vacuum gauges, and by better marketing through the manufacturer's representative program instituted in 1954, two factors were extremely important.

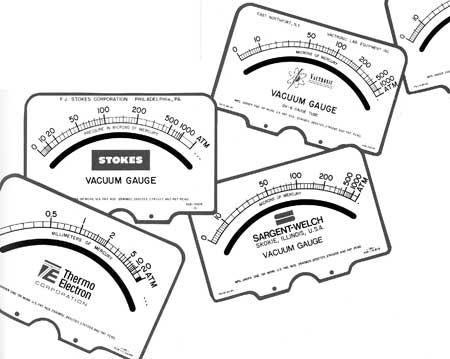

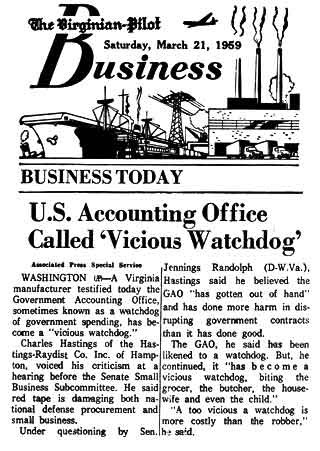

Dial faces for a variety of private label accounts.

|

The first was the decision to accept "private label" accounts. Ray Doyle remembers:

Almost concurrent with our going into the vacuum gauge business, there was a huge upswing in vacuum equipment manufacturing and instrumentation. A lot of new companies were designing and building such things as vacuum furnaces, vacuum impregnators, freeze-drying equipment, refrigeration and air-conditioning charging systems, and leak detectors. Each piece of equipment had to have a vacuum gauge in it.

At the time there were three major producers of vacuum gauges—Consolidated Vacuum Corporation, National Research Corporation, and General Electric. Then Hastings comes along. We were relatively new in the business, but we had a reputation for a high quality product and prompt deliveries.

Some of these new companies came to us and said, "We're building vacuum equipment and would like the customer to see our name when he takes a reading on the meter. If we buy our gauges from one of the major producers, we can't get them with our name on them. Then we're stuck with selling equipment that has our competitor's name on it in a prominent location. Would you be willing to sell us your gauges with our name on the dial face?"

We talked it over and decided to do it. In retrospect, it was one of the best decisions we ever made. These private label accounts were the key to the tremendous growth we've had in vacuum gauges.

The second major boost to the company's vacuum gauge business came in 1958 when the Atomic Energy Commission selected Hastings vacuum gauges for its nuclear energy and weapons programs.

The Hastings vacuum patents were unusual in that they covered both the gauge tubes and the circuitry. The Atomic Energy Commission wanted to build its own circuitry and buy the gauge tubes from Hastings-Raydist. The company agreed, licensing the AEC to build circuitry under a royalty agreement.

Besides being a very profitable contract running for several years, the AEC job enhanced the reputation of both Hastings vacuum gauges and the Hastings patents. Surely if a patent position was strong enough that the AEC acknowledged it and paid royalties, it must be a strong position indeed! For Charles Hastings, who by this time had had more than his fill of patent litigation, a reputation for having a strong patent position was a very welcome asset.

Although the instrument picture looked rosy in 1959, Ray Doyle knew that it would be tough to keep the momentum going. The AEC contract had accounted for a large volume of vacuum sales and that contract would soon expire. If nothing was done, instrument sales would not only fail to grow, they would drop off. He wanted a program to boost commercial sales. He wanted someone to spend full time working with the reps and taking the company's booth to trade shows. The name "Charlie Hawk" came to mind.

When the big layoff came at the end of 1954, Charlie Hawk had just finished lining up sales representatives across most of the country. Since all but the most essential jobs were being eliminated, Hawk's job was one of those to get the ax. Although he was given the opportunity to stay with the company as an engineer, he was interested in working in sales and decided to leave. By 1959 he was working in Cleveland as district sales manager for Kinney Vacuum Pumps. Ray called him, and talked with him about coming back to Hastings-Raydist.

Hawk returned in June 1959, just in time for Ray's other major sales initiative—the instrument conference. Ray remembers:

Manufacturer's representatives are given a tour of the plant. (1959)

|

Most companies hold some form of annual sales conference for their sales representatives. Often it is held in conjunction with a trade show, with the company having meetings with the reps before the regular day's activities begin.

After talking it over, we decided against following that common practice. Instead we decided to invite the reps to come to Hampton for a three-day conference, thinking that the value of the uninterrupted, intensive sessions would be well worth the extra time and cost. Reps would pay their own transportation, but once they reached Hampton, the company would pick up the tab for lodging, meals, and entertainment.

The first conference was held in late June, 1959, with most of the companies representing Hastings instruments sending one or more reps. During the day there were meetings and discussions centering on the various instruments, how they worked, where they were unique or different, what applications they could meet, and where they could be sold. Everyone was given a tour of the plant. One evening there was a seafood buffet, and another evening there was a party for everyone at the Hastings' beach cottage at Grand View.

When the conference was over, everyone agreed it had been a great success and that there should be more of them. For the next two years, an instrument conference was an annual summer event.

The company considered having a sales conference every year, but decided against it. Rather than let the conferences degenerate into a routine meeting—which in some years might offer only a rehash of information everyone already knew—they would hold a conference only when there were sufficient new products and applications to warrant one. Thereafter, conferences were held once every several years.

D

uring the late 1950's, transistors and printed circuits began to replace vacuum tubes and hand wiring in electronic equipment. Thanks to these technological advances, by 1960 the size and weight of both Raydist and instrument equipment had been substantially reduced.

The behind-the-meter vacuum gauge is a big hit.

|

Now Charles Hastings had a bold idea for the design of vacuum gauges. What if the circuitry could be miniaturized so much that it could all be installed directly behind the meter in a small can not more than a few inches deep! Builders of vacuum equipment wanted to build vacuum gauges directly into their equipment. If the entire vacuum gauge could be built so that it took up just slightly more room than the meter itself, it would be a great advantage to these large vacuum gauge customers. They could install one in a piece of their equipment with hardly any restrictions on their layout and design.

It would be a financial gamble, requiring a high initial investment. The company would have to design and build printed circuit boards. It would have to order many of the parts in large lots in order to get the price down far enough that it could sell the new gauge at a competitive price. Altogether, it would have to sell over a thousand of the behind-the-meter gauges just to break even, and no one was sure the market for a behind-the-meter gauge would be that large. No one had ever done it before, and it was anybody's guess how successful it would be.

The "compact" gauge was brought on the market in late 1961, priced at $110. To everyone's delight, it was a smash success, exceeding even the most optimistic expectations. Vacuum equipment manufacturers loved it, and Hastings-Raydist picked up many new customers. For the next seven years HRI had the "compact" market all to itself, as other companies were slow to copy the idea. Year after year, the gauge became more popular, sales went up, and the prices of many of its components went down. More than fifteen years went by before a price increase was necessary.

S

o far, all Air-Meters, vacuum gauges, and flowmeters had been based on the thermopile. In 1961 Jim Benson came up with an idea for an entirely new kind of mass flowmeter, based on measuring the heat capacity of a gas. Since heat capacity for a particular gas is practically constant over a wide range of temperatures and pressures, the new flowmeter could measure the flow of a gas independent of pressure and temperature.

That was only one advantage; another advantage was that the new flowmeter didn't need to be calibrated separately for each type of gas. Instead, it could be switched from measuring one gas to measuring another just by plugging in a correction factor for the specific heat of the gas being measured.

Jim Benson's new flowmeters are introduced in 1962.

|

A third advantage was that the new flowmeter could be designed to give linear readouts. A handicap of thermopile instruments for many applications was that they followed a square-law curve rather than a linear one. Since the dial faces were not linear, the precision of a reading was very high in some ranges but very low in others.

For certain applications the thermopile flowmeters were excellent. A prime example was their use in pneumatic testing of tolerances on manufactured parts. The customer chooses a flowmeter that measures very precisely in just the range that corresponds to air flowing through a correctly machined part. Then he puts the parts on an assembly line for testing. Since the response time of the thermopile flowmeter is extremely fast, he can test hundreds, or even thousands, of parts per hour.

But other uses for flowmeters cried out for a linear scale, and the thermopile flowmeters didn't provide it. Now Hastings-Raydist had a flowmeter that did.

The new flowmeters were introduced in 1962, with models measuring at full scale from as little as one-half a standard cubic centimeter per minute to as much as two hundred standard cubic feet per minute. They quickly became a major item in the Hastings line of instruments.

E

very year saw several new instruments added to the Hastings line. Not all were a success. Ray Doyle explains:

We only ever built a product that we thought had good market potential, but we fell flat on our faces on some of them. When we had an idea for an instrument, rather than hire some outfit to run a marketing survey we'd go ahead and build a few. We'd issue news releases about it, show it at a couple of trade shows and see the response. What we learned from this approach was far more valuable than running a marketing survey, and cost about a third as much.

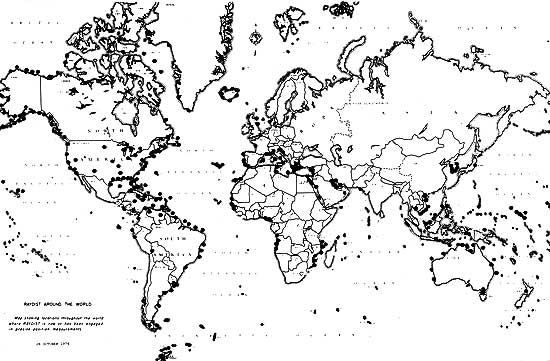

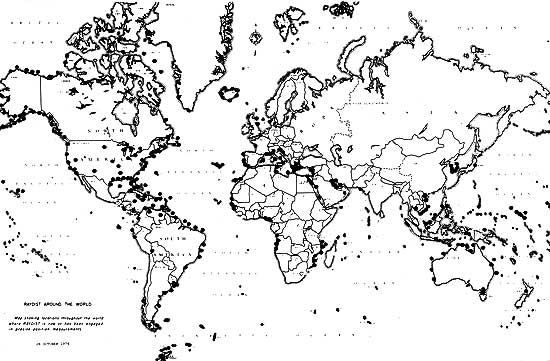

World map showing sites where Raydist operations have been made. (1974)

|

T

he Raydist of the 1940's and early '50's could get good results, but the mathematics of its hyperbolas were complicated and the equipment was heavy and bulky. In 1956 Hastings-Raydist introduced DM ("distance measuring") Raydist, a two-dimensional range system. Instead of measuring position in terms of intersecting hyperbolas, it measured position in terms of intersecting circles, a process which combines far greater accuracy with far simpler mathematics. At the same time, the advent of transistors and printed circuits made it possible to reduce drastically the size and weight of the equipment. The result was a new generation of Raydist equipment, simple to operate and easy to carry. Within a few years, range systems had replaced hyperbolic systems for most applications, and Raydist was riding the crest of a rapidly growing market for radiolocation services.

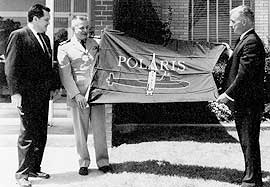

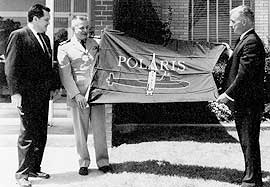

Ship testing, oil prospecting, and hydrography were the mainstays of Raydist business. One of Raydist's biggest jobs in the early '60's—big in both money and prestige—was the Polaris submarine building project. Raydist was used to evaluate the navigation and speed computing equipment on each new Polaris submarine. Hastings-Raydist provided the equipment for these contracts, and ORI provided the personnel. When Poseidon submarines superseded the Polaris subs, Raydist provided the same services for them. Hastings-Raydist was awarded both Polaris and Poseidon burgees for its contributions to these projects.

|

|

In October 1957 a Raydist team tracks Sputnik I. Clockwise from lower left are Jim Satterfield, Dalton Webb, Allen Comstock, Bill Rounion, and Charles Hastings.

|

The Air Force uses Raydist for aerial photogrammetery in Antarctica during IGY. The photo shows two relay stations, a tent that houses the master station and recording station, and the DC-3 used for the survey.

In honor of the company's contributions to the Polaris program, Charles Hastings, left, and Arthur Samet, right, receive a Polaris burgee from Captain William Chimiak, U.S.N. (1964)

|

In addition to its regular assignments, Raydist was involved in several specialized projects.

1957 saw a number of scientific projects undertaken as part of the International Geophysical Year. As part of the United States' participation, Raydist was sent to Antarctica to track and position Air Force planes taking aerial photographs. The operations were postponed for a year when a whiteout (frozen fog) prevented planes from landing at the air base in Antarctica. The following year the weather was more cooperative, and the Raydist survey was completed as scheduled.

In October 1957 the Soviet Union launched Sputnik I and Americans wondered if the United States would be able to track it. A Raydist team immediately tackled the job, and its success brought it widespread publicity around the country. Later, scientists would find that many electronic systems could also do the job, some of them at less cost than Raydist. Although Raydist did not make a sale for this job, it benefitted from the publicity.

T

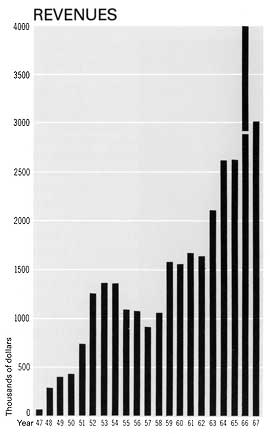

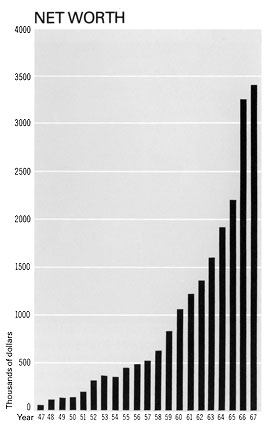

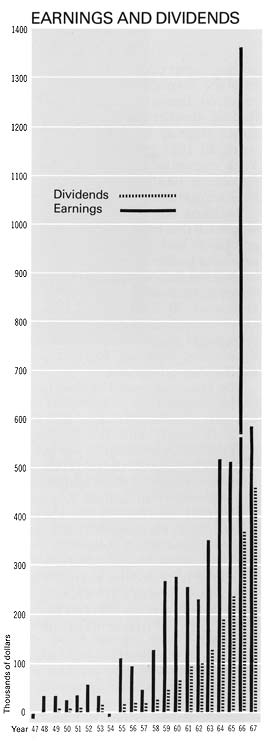

he late '50's saw a surge of increased profitability. In 1959 the ratio of after-tax profits to sales rose to a dramatic 17 per cent, and from then on it hovered just below 20 per cent.

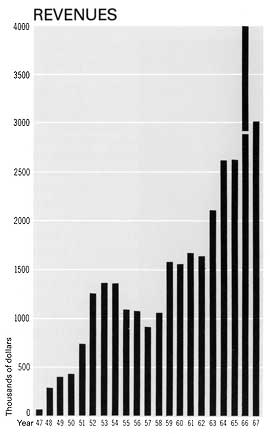

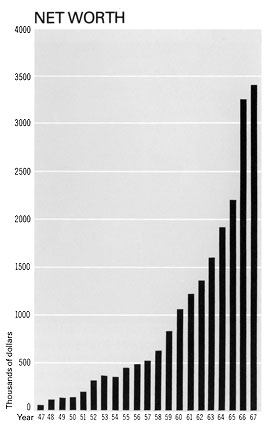

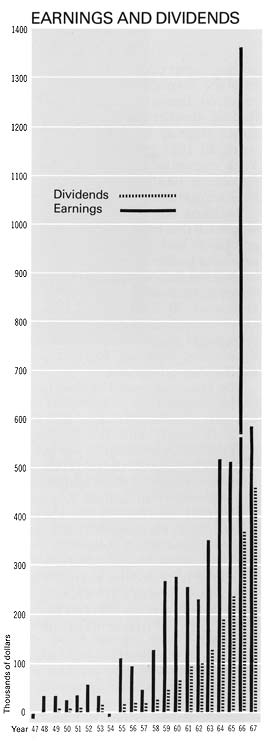

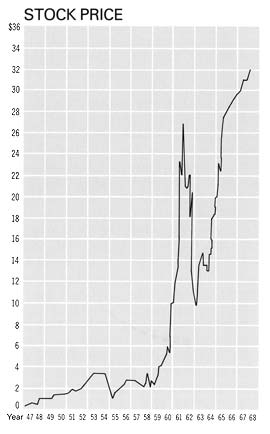

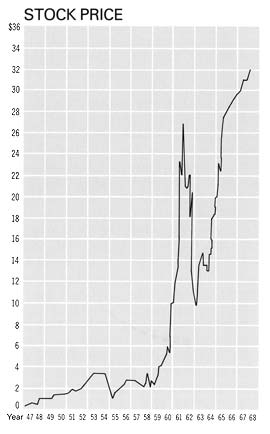

As these graphs show, the company's financial record is impressive. Even if one corrects for inflation (according to the Consumer Price Index, a 1968 dollar was worth $.65 in terms of 1947 dollars), the company has grown enormously.

[February 2010 update: in terms of current dollars, a 1968 dollar is the equivalent of $6.23, and a 1947 dollar is the equivalent of $9.72.]

|

Notes:

1. These figures are based on the combined annual operations of Hastings-Ravdist, HICO, and RNC for the respective calendar years during which each was in operation. In the graph of stock price, the figures are adjusted for stock splits, and the figures prior to 1956 are based on the price of HICO stock. RNC stock almost never traded.

2. In 1952 RNC stock was distributed to HICO shareholders in lieu of a cash dividend.

3. The small breaks in the graphs of 1966 revenues and earnings separate the results of the company's normal operations from its sale of Teledyne stock.

|

|

Part of the dramatic rise was due to the end of the rapid depreciation taken under the Certificate of Necessity granted during the Korean War. The depreciation taken between 1953 and 1958 had run over $90,000 a year. This had a substantial effect on earnings, as pre-tax earnings were comparable in size to the depreciation. Beginning in 1959, the depreciation dropped to the range of $30,000 to $50,000 a year.

But the bulk of the rise in profitability was due to increased sales, which jumped from the $1,000,000 range to the $1,500,000 range.

All of a sudden, the company found itself the beneficiary of a large cash flow. Gone were the years of having to finance some projects with large bank loans and having to forego other important projects for lack of funds.

Stockholders noticed the difference in cash flow immediately. Dividends, which had been 20 cents per share in 1956 and 1957, and 25 cents per share in 1958, shot up to 50 cents in 1959 and continued rising rapidly every year thereafter.

Employees noticed the difference too, as their fringe benefits increased. In 1956 the company instituted a group life insurance program. In 1957 a hospitalization and major medical insurance plan was added. 1958 brought employee pension and deferred profit-sharing plans—just in time to benefit from the greatly increased profits that began in 1959. In 1960 a cash bonus program began, in which every employee received a year-end cash bonus based on how the employee and the company had done for the year.

In 1963 and 1964, sales and earnings made another major leap. Now sales were in the range of $2,500,000 a year, and after-tax profits $500,000. Cash was flowing in at even more impressive rates.

Compared with the averages for the instrument industry, Hastings-Raydist was outstandingly profitable. Before-tax profits ran 34 per cent of sales in 1963, a typical year, compared with an industry average of 12 per cent. The ratio of sales to capital employed was less for Hastings-Raydist — 1.0 vs. 1.4, but the ratio of pretax profit to capital employed was enormously higher — .35 for HRI compared to .16 for the industry. The after-tax return on investment was 22 per cent for Hastings-Raydist, compared with 12 per cent for the industry.

T

he big cash flow made it easy for Hastings-Raydist to expand.

In 1959 the company purchased the adjacent property to the north, along Sunset Creek. The existing building on the property was renovated into a 1900 square foot warehouse, and a dock was built at the water's edge for the Raydist field-test and demonstration boat, the Half-Wave.

Aerial photo of Hastings-Raydist, Inc. A: main building. B: property purchased in 1959. C: property purchased in 1963. D: property acquired in 1966.

|

In 1963 it bought the waterfront property directly across the street, on the other side of Newcomb Avenue. The 9000 square foot building on the property was used for storage, and the vacant land was made into a parking lot.

It wasn't long before the company was again running short of space. By 1966 the building across the street was being used for glassblowing and computer operations as well as storage, and engineering and calibration had been moved out of the overcrowded main plant into the small building near the dock. The company was making plans to build a new, large, modern building on its land across the street.

For many years Hastings-Raydist had had its eye on the adjacent property to the south of the main plant as a possible site for expansion, but the property had been unavailable. Fortunately, the company was able to get this property in late 1966. Now, rather than build an entire new building from scratch, it would be able to build a major addition on the south side of the present main building. Soon plans were drawn up calling for an addition of 23,000 square feet. The expansion would relieve the overcrowding, allow everyone to work in the same building again, and provide space for gradual growth.

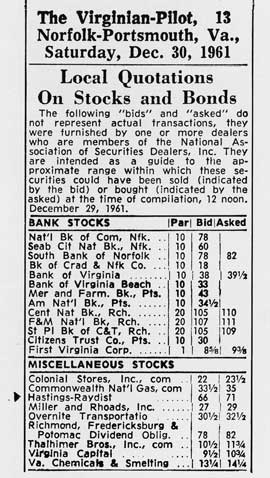

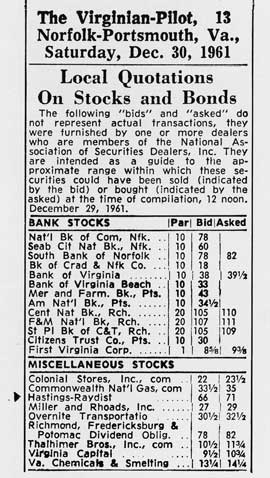

In the early 1960's Mason & Company, a local brokerage house, begins making a market in Hastings-Raydist stock. Bid and asked prices are listed in the newspaper. The stock splits three-for-one in 1962.

|

E

ven with the expansion, there was cash to spare.

In the summer of 1959, Jim Benson spoke with Charlie Hawk. "Charlie," he said, "the company has some money it would like to invest. In your travels around the country, you see a lot of companies. if you run across some that look like they have real promise, let me know. We'd be interested in buying part of a good, small company."

"From my general observations," Hawk replied, "it seems that most companies which do something like that take a look at what they use the most of, and buy a part of their major supplier. That way they protect their source of supply and make a profit off their own purchases. I don't know what we use the most of here, but I'll bet it's meters."

The figures were checked, and Hawk was right. By far the company was spending more on meters than on any other single item.

Most of the meters came from Assembly Products, Inc., of Chesterland, Ohio. Charles Hastings got in touch with John St. Amour, president of Assembly Products. It turned out that API was expanding, and needed cash.

Before long they had worked out a deal. In the spring of 1960 Hastings-Raydist purchased 10,000 shares of API stock at $11.50 per share. The following year it exercised an option to buy 10,000 more shares at $12.10 per share. Owning 20,000 shares made Hastings-Raydist owner of five per cent of the company, and resulted in a very close relationship between the two companies.

In 1962 Hastings-Raydist invested approximately $40,000 in 4000 shares of stock in Vacuum Electronics Corporation of Plainview, New York. Veeco was one of the company's best customers for instruments and gauge tubes, and also had been its first licensee. It had manufactured Hastings vacuum gauge circuits since 1954. HRI, on the other hand, had been a customer of Veeco, too, buying several of its products.

In mid-1964 Charles Hastings came upon another possibility for investment. Specialties, Inc. of Charlottesville, Virginia, was a manufacturer of proprietary aircraft instruments and other patented devices. It had been having serious financial problems, and plans were being made to reorganize the company as Automated Specialties, Inc. Additional working capital of $600,000 was needed.

Over the years Hastings-Raydist had passed up many military contracts for Raydist because it was unwilling to put up with the red tape and in-plant inspections these contracts required. Instead it was interested in finding another company to which it could license or subcontract such work. In 1961 it had licensed a New York company to do this, but the agreement hadn't worked out and had been terminated.

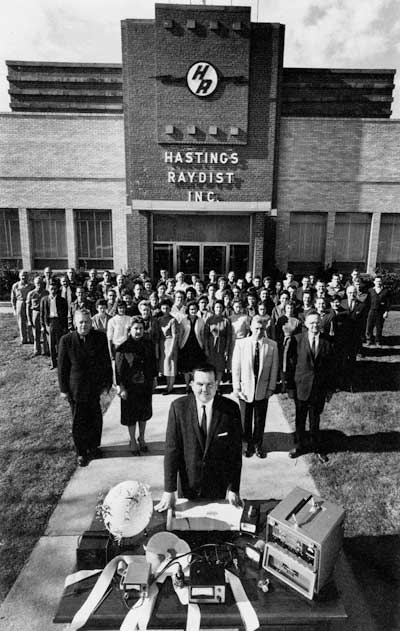

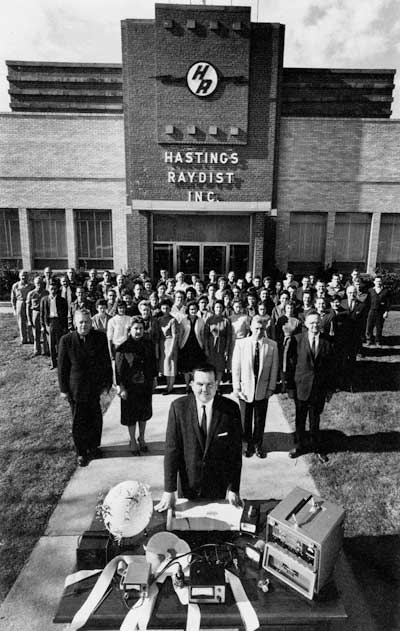

In 1963 Charles Hastings is awarded the Distinguished Alumnus Award from his alma mater, Johns Hopkins University. With samples of his equipment in front of him and his employees behind him, he poses for a photograph to be published in the university's alumni magazine.

|

Perhaps Automated Specialties would fill this role. The Charlottesville company had experience producing products under military contracts. Its inspection and quality control procedures were already approved for military work. It had ample capacity. A close association between the two companies might lead to Automated Specialties building Raydist sets to military specifications.

The Hastings board of directors decided to invest up to $200,000 in the venture. Half that amount was put in early in 1965, with the expectation that the balance would be put in at the close of the year. By the end of the year, however, Teledyne, Inc., had made an attractive offer to acquire Automated Specialties, and the offer had been accepted. Now Hastings-Raydist owned 1,948 shares of Teledyne.

In late 1966 Hastings-Raydist sold 10,500 of its Teledyne shares. The result of the sale was a $1,103,000 gain—$800,000 after taxes—in less than two years on an investment of only $100,000!

The impact of the sale on the Hastings-Raydist financial statements was enormous. Not counting the sale, the company had had a good year in 1966. It had made an after-tax income of $566,000, or $1.91 per share, an 11 per cent increase over the year before. Adding in the sale, the company reported earnings of $1,365,000, or $4.61 per share, over two and a half times those of the prior year.

It was almost an embarrassment of riches. "I'll agree that the figures for 1966 look great," Mary Hastings kidded the other officers, "but how about the figures for next year? What are we going to do for an encore?"

next chapter >>

Copyright © by Carol Hastings Sanders

|